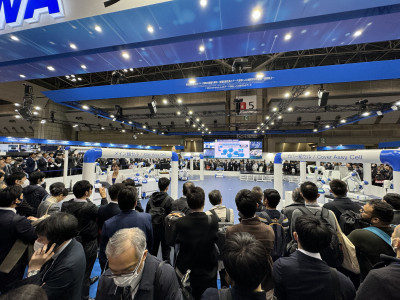

Japanese manufacturers are responsible for 40% robot sales around the world. To understand the global robotics market, a look inside Japan is indispensable. iREX, which claims to be the world’s largest robotics show, is a great way to do just that. After an absence of four years, Georg Stieler attended the show again. Here are his observations.

1. More Cobots with Value-Added Applications

Collaborative robot (cobots) took on an even more prominent role this time. Yamaha launched a seven-axis cobot. Universal Robots launched its new UR30 large-load cobots at the show. FANUC and DENSO placed some products from the same category, which had already been introduced earlier this year, prominently.

FANUC, DENSO, and UR presented some interesting demos of high force torque tightening, precision assembly, polishing, and screw seating inspection – applications that require intelligent use of integrated power sensors. FANUC also highlighted its smooth direct-teaching capabilities for welding, powder coating or with payloads up to 30 kg (66.1 lb.).

The fact that several large manufacturers gave cobots such a prominent presence highlights the strategic importance they’re now giving this product category.

2. 'Zero Teach' Robotics

Machine vision combined with automated path generation received a boost since my last visit. “Zero teach” is the new buzzword.

Traditional applications are random part picking and easy palletizing. This has been shown by a multitude of robotics manufacturers, as well as machine vision companies that are also offering robotic motion control – such as Mujin from Japan or Mech-Mind from China. The former also presented its TruckBot, an autonomous robot that can unload both truck trailers and shipping containers at a rate of up to 1,000 cases per hour.

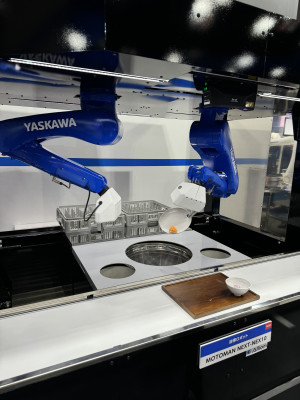

FANUC showed auto path generation for arc welding. Both FANUC and YASKAWA showed zero-programming solutions for easy palletizing. Under the name “Motoman Next,” Yaskawa presented some applications for verticals such as dishwashing, food inspection and sorting, and laboratories.

At this point, these are more demonstrations of what can technically be done, as Yaskawa is just starting to offer these solutions to customers.

3. Variable-Mix, Variable-Volume Automated Lines

The booths of OMRON and Yaskawa featured variable-mix, variable-volume automated lines. These lines showcased mobile cobots and layout-free production, enabling adaptability in the production environment and on-site data management for continuous productivity and quality improvement.

Yaskawa is using its I3-Mechatronics platform for this, a promising approach after Japanese automation suppliers came to embrace the concept of interconnected production processes relatively late. Yaskawa’s new YRM-X controller controls several machines along a whole line.

4. High-Payload Robots

Like in other countries, Japanese robotics companies have a legacy in the automotive industry. This is still reflected in the introduction of some high-payload robots. FANUC introduced a new serial link robot with a 500 kg (1,102.3 lb.) payload, overflip capability, and integrated 2D and 3D cameras. Target applications is the handling of heavy automotive parts. Yaskawa presented the Motoman-ME1000, a SCARA robot with a payload of 1,000 kg (2,204.6 lb.) tailored for the handling of electric vehicle batteries.

5. Strong Presence of Chinese Players

Fifty out of the 121 international exhibitors were from China. They were primarily manufacturers of cobots (AUBO Robotics, Elite Robots), mobile robots, machine vision (Mech-Mind Robotics) and core components.

As a large market with close geographic proximity, Japan is an opportunity for Chinese players to mitigate the cut-throat competition at home.

6. Japanese Robotics Companies Collaborate on SME Automation

Maybe the most important news for the Japanese robotics industry these days came a day before the start of iREX 2023. The Robot Industrial Basic Technology Collaborative Innovation Partnership (ROBOCIP), a group including major Japanese robotics and automation companies, announced that it is creating a joint database to facilitate the introduction of robots at small and medium-sized enterprises (SMEs).

According to a white paper by the Japanese government, SMEs are responsible for 99.7% of Japanese companies, yet the value-added per worker for the country’s SMEs in manufacturing is just over one-third of that for its big businesses. At the same time, SMEs often lack the funds for capital investment.

The new system is supposed to speed up the automation of this sector by sharing some basic information on robot specifications, operations and software. It is set to be available in 2024 and is supposed to reduce integration costs by up to 60%. Access will be free for smaller companies in the beginning.

In addition to robotics manufacturers such as FANUC, DENSO, Panasonic, Yaskawa, NACHI, Kawasaki, Epson, Daihen and Mitsubishi, the initiative is supported by the University of Tokyo, the National Institute of Advanced Industrial Science and Technology and the New Energy and Industrial Technology Development Organization. The program is open for further participants to increase the completeness of the database and ultimately the competitiveness of the Japanese manufacturing sector.

In the future, the group is considering combining generative artificial intelligence with its database to further lower the threshold for automation. A similar approach by Google Deepmind and 33 research institutions recently has shown some promising results.

Positive Outlook

Initiatives to boost productivity through more automation are urgently needed in Japan. The country’s economy has been stagnating for three decades, and its post-pandemic recovery remains fragile.

A shrinking population further limits the upsides to its growth. Despite Japan’s distinctive cultural traits, such as its approach to immigration, its advancements can serve as a model for other countries facing aging populations.

As companies are re-evaluating their geopolitical risks and are moving some of their supply chains, Japanese factory automation firms stand to benefit.

Corporate culture in Japan seems to be changing, too. Corporate governance reforms are pressuring management teams to enhance corporate value and return on equity. The average age of CEOs at firms in the Nikkei stock index has dropped by 12 years over the past decade. While Japan’s startup ecosystem is still small relative to its GDP, it is becoming increasingly vibrant. Investments grew tenfold from 2013 to 2022, and the number of VC funds quadrupled.

Notions of these changes are already becoming visible at Japanese robotics and automation enterprises. Foreign companies mentioned that they are becoming more open to collaboration with a new leadership generation. I am already excited for the next iREX in two years.