What are the key growth industries for manufacturing technology suppliers in China through 2025? Explore the sectors poised for expansion and understand the trends shaping their development with our study "China's Future Industries".

China was the only major economy in the world whose gross domestic product grew during 2020. The International Monetary Fund expects the country to grow by almost 8 percent in 2021.

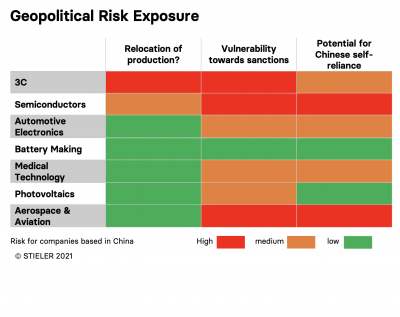

For foreign technology suppliers, this is a double-edged sword: On the one hand, this dynamic benefits them and offers attractive opportunities, especially in the short to medium term. In the long term, however, Beijing's quest for technological self-sufficiency cannot be ignored.

In this context, our team in Shanghai analyzed the following seven industries in this study:

A Powerful Tool for Your Strategic Planning

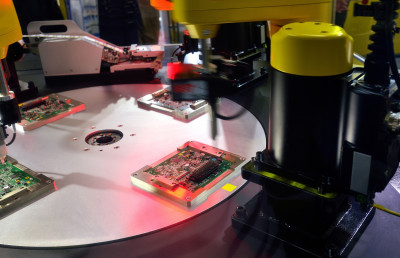

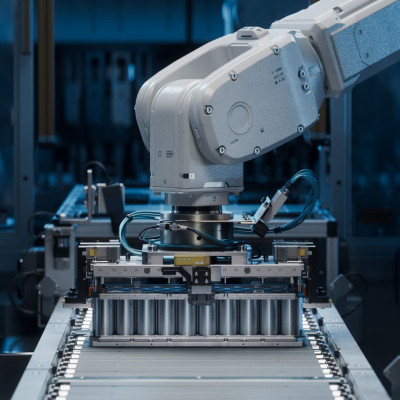

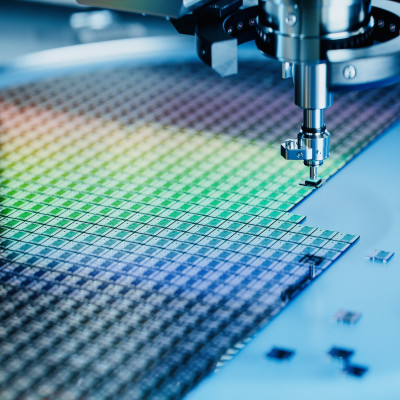

Based on the insights from our work for providers of machine tools, robotics, automation equipment, and related software, these are the most dynamic sales industries for manufacturing equipment in China these days. All of them show positive growth due to political support and technological progress. In the study, we describe them according to the following aspects:

Value chain

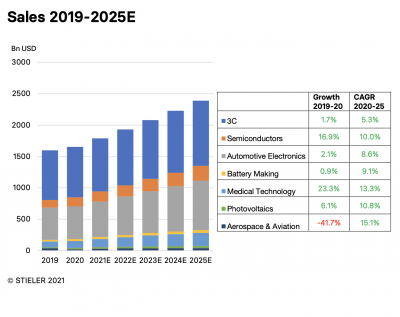

Growth 2020 + outlook 2021-2025

Competitive dynamics, new product and technology trends

Political goals and initiatives

Most important foreign and domestic companies (description, key figures, locations)

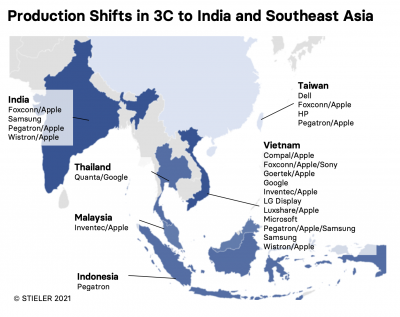

Industrial clusters, including projects to build new production capacities (depending on the industry, also in India, Southeast Asia and other parts of the world)

The study thus answers the following questions, among others:

New Capacities

Which industries will contribute the most capacity expansions during the coming years?

What are the political and economic considerations behind these plans?

Where are the capacity expansion projects of the leading companies located?

Emerging Chinese Champions

Which domestic companies will benefit most from Beijing's Dual Circulation Strategy and Fourteenth Five-Year Plan?

Who is best positioned to survive the boom and bust cycles typical in China's economy?

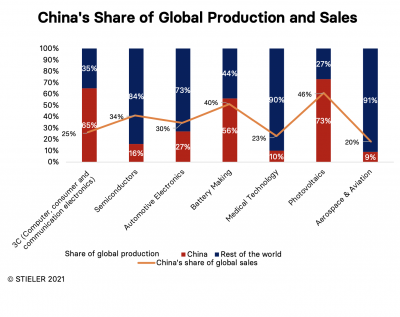

Geopolitical Risk Analysis

What tendencies towards relocation to other countries can be observed?

How vulnerable are the respective industries to sanctions and export restrictions?

Until when will China be self-sufficient in these industries?

Basis for Custom Projects

The study has 140 pages and is offered with a complimentary webinar. It describes a total of 176 companies. 125 of them are domestic firms, 51 are multinationals.

Excerpts

Media Coverage

More Information

Learn more about our study "China's Future Industries".