Looking back at 2025 and ahead to 2026, there are several developments and insights I'd like to share:

Year in Review

We were early to mention DeepSeek in our last annual review and outlook. Just a few weeks later, it caught many by surprise with a Large Language Model (LLM) reportedly developed at a fraction of the cost of ChatGPT. Today, it is increasingly clear that Chinese firms are not far behind the U.S. in LLMs (despite limitations on compute), and that they have distinctive advantages in Physical AI—driven in part by their proximity to the electromechanical value chain (which the U.S. largely outsourced 30 years ago).

On the ground

China: I visited four times (over 100 days in total). Among other work: a roadshow for a client in the automation industry where we visited 20+ companies (system integrators and robotics companies); M&A matchmaking and strategic due diligence (technical services). One appreciates the things that do work well in China much more when you are not there all the time.

USA: Two trips to keep a pulse on the opposing ecosystem.

Keynotes & Panels in Shanghai, Munich, Chicago, Santa Clara, and Stuttgart.

Writing

Tokyo for iREX was a great trip towards the end of the year. I’ve shared my highlights in English here and in German here.

I also published several in-depth pieces, including a comparison of robotics ecosystems and what Europe must do (in German): Read here.

Outlook 2026

China

1. Politics It is really difficult to call. However, we remain cautiously optimistic that there will be no further escalation regarding Taiwan this year.

2. Economy and industry Overall, the theme is "muddling through". The years of double-digit growth are over. While Chinese industrial policy has fundamentally changed the global distribution of power in several industries (NEVs, robotics, machine tools, semiconductors), it didn’t necessarily create healthy industries. The resulting pressure on margins can now be felt way beyond China.

We are seeing a clear bifurcation of important tech stacks (semiconductors in particular). Huawei and TSMC might emerge as the big winners here.

The internationalization of Chinese companies will continue, a trend clearly visible during Automatica, SPS, and iREX (despite the tensions between China and Japan in December). The smarter companies will understand that they need to localize management to be successful globally.

3. Robotics and Physical AI China is moving alongside the U.S. to the forefront of development in Physical AI. By our estimates, investment in early-stage robotics companies in both the U.S. and China in 2025 was roughly five to six times higher than in Europe.

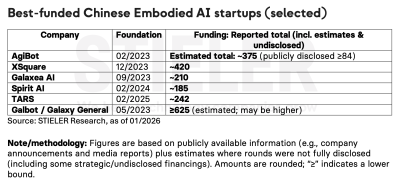

In China alone, we see at least five embodied AI companies that have each raised more than $210 million to date, and capital continues to flow aggressively into the space. Both at the World Robotics Conference in Beijing and at the CIIF in Shanghai, we witnessed advancements that are not yet showcased—or simply don’t exist—in Germany. Watch here

While many in Europe have primarily been watching U.S. initiatives, China is increasingly producing approaches that are equivalent and, in some cases, complementary along the trajectory toward “physical intelligence.” The differentiator is less about a fundamentally different stack, and more about the consistent combination of building blocks that separate a compelling demo from reliable deployment.

What to expect in 2026

From hype to value: We expect a shift away from headline-grabbing spectacles toward real applications with commercial value. Investors are demanding it.

The anticipated IPO of Unitree in 2026 could become one of the most significant Chinese robotics listings in some time, with others likely to follow. In the meantime, the market will begin to consolidate.

Specialization: Whereas U.S. companies (Physical Intelligence, Skild.ai, Google Gemini Robotics) still lead on generalization, Chinese providers (X Square, TARS, AgiBot, Galaxea, Galbot) could benefit from offering full-stack systems built around clearly defined tasks. This enables faster iteration cycles, higher reliability, and better cost/performance ratios.

We expect a shift away from headline-grabbing spectacles toward real applications with commercial value in humanoid robots. Chinese investors are demanding it.

A moment of epiphany at iREX Tokyo

Solomon tuned a Unitree G1 humanoid with more capable hands and an NVIDIA Jetson AGX computer. The robot was trained to see, understand orders in natural language, and plan the physical steps to pick from a defined set of objects. Yes, the application was still shaky, but it provided a glimpse into the future. Every serious Chinese humanoid robot company has such demos in their labs. A "ChatGPT moment" for embodied intelligence—where robots generalize natural-language instructions to new, non-preprogrammed tasks—no longer feels like pure science fiction. Watch the short clip here

United States

Despite all the noise, the underlying optimism remains refreshing—and capital is moving accordingly. The return of manufacturing might finally take shape, and Silicon Valley has clearly rediscovered robotics.

Jeff Bezos and others invested $6.2bn in Project Prometheus, a startup focusing on AI for the engineering and manufacturing of computers, automobiles, and spacecraft. Google co-founder Larry Page is said to be working on something similar with Dynatomics.

Boston Dynamics and Hyundai stole the show in Las Vegas with the new Atlas. With Google Gemini Robotics, they likely have one of the strongest software partners in the field. Hyundai, through its subsidiary Mobis, aims to mass-produce 30,000 Atlas humanoids per year by 2028.

Andreessen Horowitz just raised a massive $15bn fund with substantial allocations for "American Dynamism," Growth, and Infrastructure. Their mission is to ensure America wins the next 100 years of technology.

Europe

Europe faces structural headwinds: Overregulation, high energy costs, and slower scale-up dynamics. The ongoing conflict in Ukraine continues to strain resources and sentiment. There are still world-class industrial assets and talent here, but 2026 will require a change in course.

What we are currently working on

(and how we can help)

Helping robotics and automation companies sharpen their international go-to-market (Europe, U.S., India, etc.) — incl. partner/channel mapping and commercialization support

China Learning Excursions: Innovation in robotics and Physical AI

How Chinese mechatronics and AI ecosystems can be leveraged for global success

New business opportunities for suppliers in humanoid robotics — in (but not limited to) China

If any of these topics resonate with you, let's talk.

PS: If you want the longer version

A personal highlight to start the year: I recently sat down with Kyle Chan from the Brookings Institution in Washington D.C. We dived deep into China’s robotics/EV ecosystem, global tech competition, and what Physical AI brings next.

Listen here: YouTube | Spotify | Apple Podcasts