Facing a changing China, global companies reassess their strategies. Georg Stieler examines the factors making China a tough yet vital market, from its role in global supply chains to its technological strides. Understand how businesses navigate these waters, balancing engagement with the need for diversification.

Foreign Direct Investment (FDI) to China is at its lowest level in 30 years. The significant mistrust among international investors is fueled by uncertainties about how China will implement its policies on national security and other areas, as well as concerns over structural reasons for the slower economic growth.

The pandemic and even more so the Ukraine conflict have drastically changed the landscape, prompting multinational companies to reassess their risk profiles. Trade barriers have introduced unprecedented challenges to global supply chains. For example, in mid-February, thousands of luxury cars from the Volkswagen Group were stuck in U.S. ports due to components from Western China, which were found non-compliant with US customs rules. In Brussels, discussions are underway about anti-dumping measures to counter the influx of Chinese electric cars.

All of this reduces the willingness to engage in China. Despite these challenges, the country accounts for nearly 90% of Germany's trade volume in the Asia-Pacific region. The notion that other countries could seamlessly replace China, as some politicians in Berlin hope, is far from straightforward. How should European companies navigate this strategic dilemma?

The difficulties facing China's property market and the poor performance of stock markets in mainland China and Hong Kong are widely reported. What frequently goes unnoticed these days are the areas in which China is establishing new benchmarks.

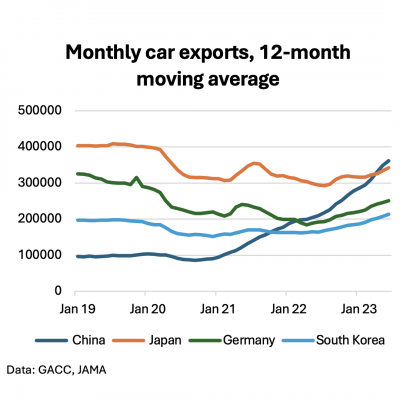

China as the World's Largest Car Exporter and Leader in Electromobility

Last year, China overtook Japan as the world's largest car exporter. BYD has surpassed Tesla to become the largest electric vehicle manufacturer globally. This achievement is the result of smart industrial policies. The support for electric vehicles dates back over a decade and has included a wide range of measures: purchase and production incentives, tax breaks, disadvantages for combustion engines, and extensive local government support, most of which have since expired.

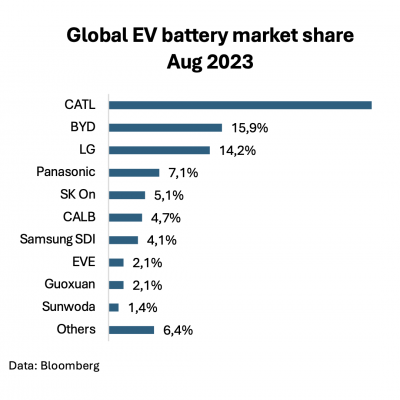

Even if the EU were to protect its market with trade tariffs, there is a high chance that leading Chinese manufacturers would still remain competitive. Chinese companies account for about 65 percent of the global market for lithium-ion batteries. A significant cost advantage for BYD, arguably the most formidable competitor, is the company's experience in manufacturing lithium-ion batteries. BYD's batteries are among the cheapest in the world, yet they also rank among the best in terms of energy density. Among the customers are competitors such as Tesla and Toyota. The next frontiers include advanced driver assistance systems (ADAS) and hydrogen technologies.

Like all key industries identified by the Chinese government, the electric car industry suffers from overcapacity. Intense competition forces companies to innovate more aggressively. Design and technology are bolder, partly because Chinese consumers are more technology-savvy.

The majority of manufacturers may disappear. However, many American railway companies in the 19th century also went bankrupt but laid the groundwork for the country's economic rise.

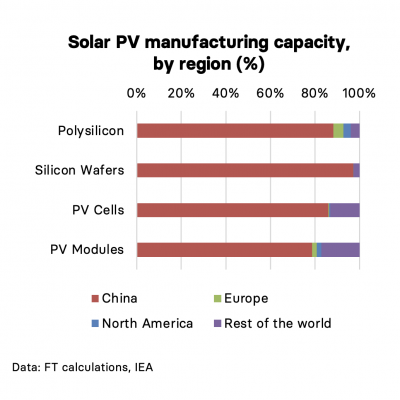

No Solar and Wind Power Without China

Chinese manufacturers dominate all stages of the solar energy supply chain even more than in the battery sector. Production capacities doubled between early 2022 and the end of 2023.

Chinese manufacturers now account for over 60% of the global wind turbine market. Furthermore, China is responsible for over 80% of the global production of neodymium, a rare earth element essential for electric motors, wind turbines, and other modern electronic products.

As for raw materials overall: China has acted with considerable strategic foresight in this field. After decades of neglect in European mining, there are no companies that could, like the Tsingshan Group, send thousands of employees to an island in the Indian Ocean for a few years to establish nickel production.

New Products Require New Manufacturing Approaches

As early as 2018, Takero Kato, today head of Toyota's battery car division, reported seeing machines in China that the Japanese did not even know existed. Chinese robot manufacturers have since increased their market share from 32% to just under 45% by the end of 2023. Newcomers like ESTUN have recognized the significant scaling potential of complete solutions for battery manufacturing and dominate this area. Chinese robot manufacturers have successfully replicated this strategy in photovoltaics.

In electronics manufacturing, there's a shift towards Southeast Asia, yet Apple increasingly relies on electronic contract manufactureres from mainland China rather than Taiwan. Their partner for producing the Vision Pro headset, currently the most sophisticated consumer electronics product in the world, is Luxshare, not the better-known company Foxconn.

Artificial Intelligence: Achilles Heel Semiconductors, Contradictions in Generative AI, and Catch-up in Autonomous Driving

The Achilles heel of China's AI ambitions is the lack of capabilities to independently produce the most advanced semiconductors and the limited access to these technologies. China also lags in developing large language models (LLMs). There's a difficult-to-resolve contradiction between the content-rich nature of generative AI and strict censorship. Moreover, stringent regulations slow down the introduction of new solutions.

Nevertheless, no other country is pushing forward with large national projects to build digital infrastructure as decisively as the People's Republic. This again could favor the development of future AI applications. Initial progress is visible in autonomous driving, where the gap with the USA seems to be narrowing, thanks to state funding, increased research investments, generous data access, and consumers' openness to new technologies.

What Do Chinese Companies Do Differently?

"Single-threaded Leadership," a concept originally introduced at Amazon, has not been formally adopted by Chinese companies but seems to be intuitively practiced by many. The idea aims to reduce management distractions significantly by assigning a leader a clearly defined task, a budget, and a timeframe, usually to solve a specific problem.

As detailed in the Harvard Business Review in early 2023, the household appliance conglomerate Haier is not organized as a top-down pyramid but as a platform of 4,500 self-managing companies that share resources, including back-end resources and other micro-companies' capabilities, to adapt to market changes. The intrapreneurs have a laser-sharp focus on their specific projects, free from vertical reporting obligations and the need for cross-departmental coordination. The sole focus is on a 12-person business (on average) with a clear goal. Most private Chinese companies lack the entrenched legacy processes that the Agile movement is now trying to combat. Many of today's private Chinese companies are lean, efficient, and eager to compete on global markets.

The Chinese market often requires different solutions. As shown in a survey from the MIT Sloan Management Review from fall 2022, Chinese companies develop ideas closer to the customer, and innovations are more market-driven. According to the survey, companies in China are about twice as likely as elsewhere in the world to draw on customers, competitors, or operational staff as a source of innovation.

As an employee of a European software company that also maintains a development department in China observed, Chinese colleagues work significantly harder, often at the expense of their own health.

Despite efforts to de-risk, disengaging from China is challenging :A study by the Rhodium Group from New York, published last Fall, concluded that moving factories from China to other countries would have little impact on China's manufacturing power, as these factories would continue to depend on Chinese suppliers for materials and components. China maintains a dominant position in manufacturing various goods, demonstrating its factories' ability to keep overall costs low even as average wages for Chinese workers have risen. Chinese factories also benefit from favorable loans from domestic banks and a wide range of suppliers for almost any conceivable component and raw material. Logistics costs in China are only a fraction of those in India, which cannot compete with Chinese port and road infrastructure. This means that emerging manufacturing nations like Vietnam, India, and Bangladesh face significant challenges in competing with China.

The stance of German politics is bizarre in this context. Artificially high energy prices, increasing bureaucracy (such as the supply chain law and energy efficiency law), high taxes, and transfer payments reduce incentives to work. Moderna completed the approval process in the Shanghai district of Minhang within three months at the end of 2023. Local government teams worked night shifts to respond to the time difference with Massachusetts promptly. Can we imagine such efficiency in any administration in Germany these days?

Strategic Implications for Western Companies

Successful foreign firms give their Chinese branches more decision-making freedom, adopting the strategies of local competitors. This includes shorter feedback loops in product development, breaking down silos, and softening hard milestones.

Western companies must carefully monitor the new competition, identify scalable new opportunities early, and consider how to leverage parts of the powerful ecosystem to their advantage. This could involve sourcing, production, or even R&D in future industries. For example, if a traditional competitive advantage for an automation company was proximity to the German automotive industry with its leading combustion engine technology, development here must pivot to electric cars (or eventually hydrogen) to maintain a global leadership role.

Consultants serve as a bridge between China and headquarters, systematically identifying and evaluating opportunities. They can convey messages more effectively, as they need to take less account of corporate internal politics. In an era where borders are open again, but the flow of information and exchange remains constrained, this is more crucial than ever.